One of the greatest barriers to continuing education beyond high school is cost. Through Registered Education Savings Plans (RESPs) and the Canada Learning Bond (CLB), the Government of Canada can help youth aspire to attend post-secondary.

The Canada Learning Bond (CLB) is money that is deposited directly into a RESP from the Government of Canada. The initial payment is $500.00 for the first year the child (beneficiary) is eligible, plus $100 for each additional year of eligibility up to the age of 15, for a maximum of $2,000.00. Once a child turns 18, they can become a subscriber of their own RESP and request the CLB themselves, until the day before they turn 21. Children in care, for whom a Children’s Special Allowance is payable, are also eligible for the CLB.

Personal contributions are not required to receive the CLB. However, if you do make personal contributions to the RESP, the Government of Canada may match up to 20% as part of the Canada Education Savings Grant (CESG). The lifetime limit for the CESG is $7,200.

To be eligible for the CLB, the beneficiary must:

- Be a resident of Canada

- Have a Social Insurance Number (SIN)

- Be named as a beneficiary in an RESP

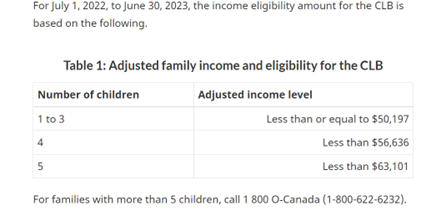

- Be from a modest income family

The primary caregiver of the beneficiary must:

- Have filed income tax returns for each year they wish to request the CLB for the beneficiary

- Be eligible to receive the Canada Child Benefit (CCB)

If the beneficiary does not pursue post-secondary education, the CLB is returned to the Government.

Qalipu First Nation has a limited number of $500.00 participant bonuses for members, or children of members, who open a RESP and eligible for the Canada Learning Bond.

The process is easy, just contact Kevin Green, CLB Project Coordinator and he will support you through every step.

Contact Information:

Kevin Green – CLB Project Coordinator

Phone: (709)643-3191

Email: kgreen@qalipu.ca